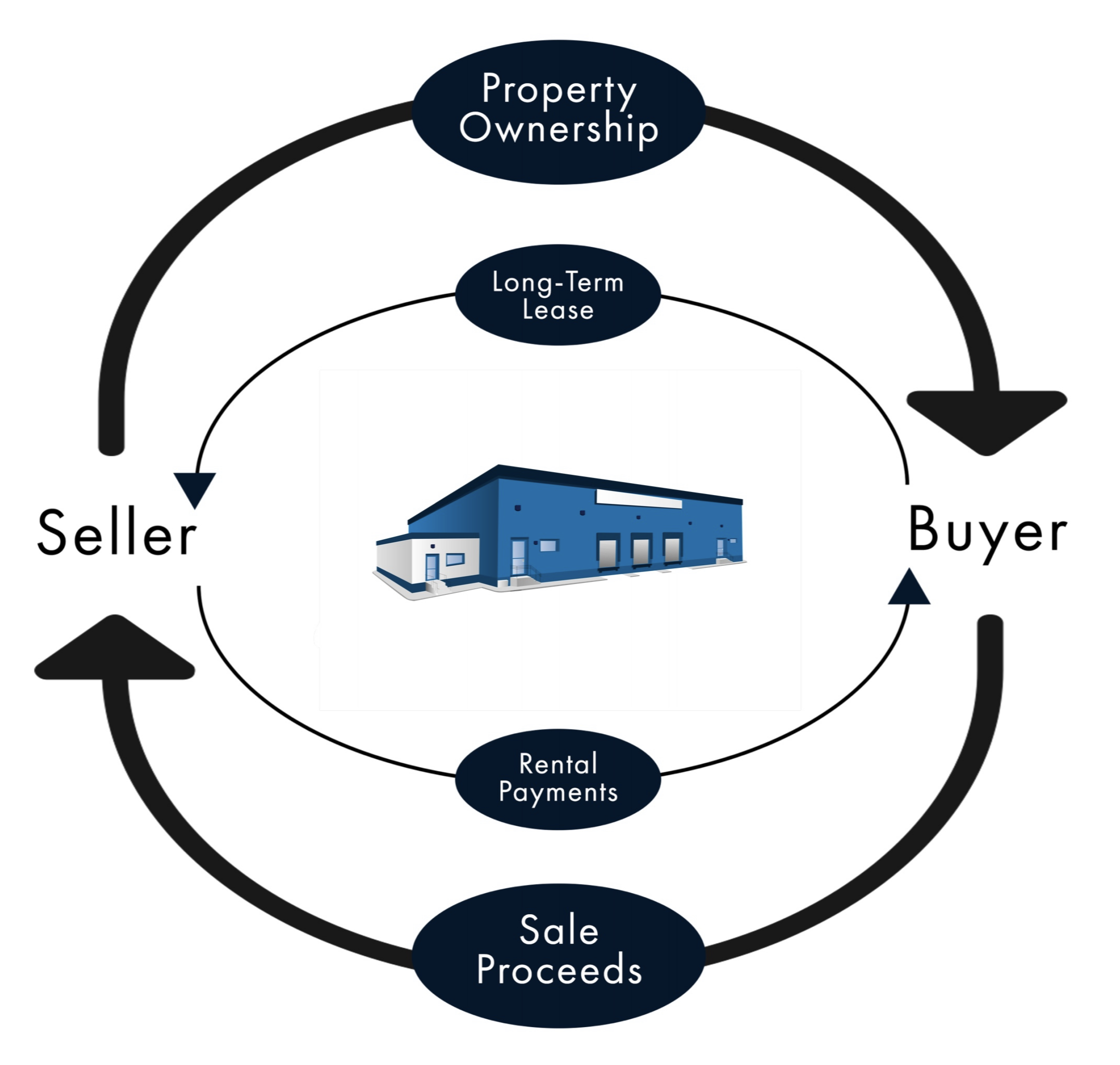

Sale-leasebacks are continuing their meteoric rise in the M&A world, and private equity firms that aren’t yet taking advantage of these arrangements “could be leaving money on the table,” according to a new survey by the Association for Corporate Growth.

J.C. Penney is perhaps one of the most prominent examples of a high-profile company using sale-leasebacks to unlock liquidity during tough times. Other examples include Bed Bath & Beyond and Big Lots, which completed successful sale-leasebacks (each with Chicago-based Oak Street) this year, the ACG notes.

Last month, Bed Bath & Beyond sold 2.1 million square feet of space to Oak Street for $250 million in a deal that included retail stores, the company’s corporate headquarters and a distribution facility; the company is leasing the properties back pursuant to a long-term agreement. Oak Street’s $725 million sale-leaseback deal with Big Lots gave the firm control of four Big Lots distribution centers while allowing Big Lots to pay down debt.

“I truly believe this is the best environment since the [financial crisis] for the execution of sale-leasebacks, both from a buy-side and sell-side perspective,” Oak Street CEO Marc Zahr told Middle Market Growth, the official publication of the ACG, in an interview. “Broadly speaking, investors are moving into higher quality assets as a result of the pandemic. There is a flight to safety.”

Cap rates are also decreasing thanks to low interest rates, making these deals more attractive, Branford Castle Partners Managing Director Erik Korsten told MMG.

“For middle-market private equity, there is usually an accretive opportunity to sell real estate,” Korsten said in an interview with MMG. “Current cap rates remain favorable—at least for more stable industries.”

Yet despite this, 80% of respondents in the ACG survey said they had never done a sale-leaseback transaction, despite the fact that 40% have mortgaged debt on their real estate holdings. More than half of those surveyed said they’ve done nothing to negotiate their leases since the pandemic took hold, while 36% said they’ve negotiated leases with their landlord directly.

Zahr told MMG that long-duration, triple-net leased and investment-grade properties are the best places for PE firms to stash capital, and said that the COVID-19 pandemic has allowed investment-grade companies to engage in sale-leasebacks that buttress their balance sheets. Big Lots’ stock price shot up nearly 30% after it announced its sale-leaseback deal with Oak Tree.

Sale-leasebacks also allow sellers a way to get capital flowing to build up operations, such as when Chicago-based Green Thumb Industries sold part of its real estate portfolio to IIP through three such deals. Sellers are also able to dictate the terms and length of a leaseback according to what works best for their business.

There are downsides, of course: in a typical sale-leaseback arrangement, the tenant/seller doesn’t retain an ownership interest, which means they give up the right to any appreciation on the property’s value, and an inability to make rent requires renegotiation of the lease.

Source: https://www.globest.com/2021/02/12/the-untapped-potential-of-sale-leasebacks/