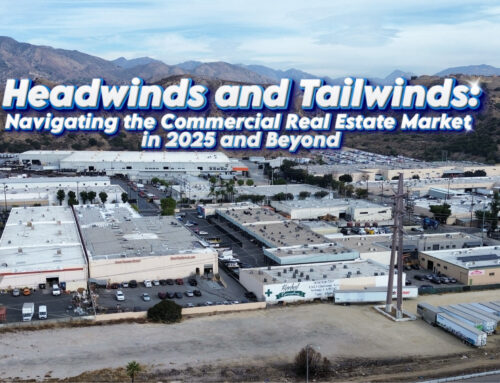

The Ports of Los Angeles and Long Beach — together, the nation’s busiest — continue to experience record volumes, leading to double-take-worthy industrial fundamentals nearby.

The Port of LA reported that between June 2020 and June 2021, it broke eight monthly records and experienced the top four individual months in its 114-year history. Import volumes for the first six months of the year were up 42.6% compared to the same time last year, a Cushman & Wakefield report noted, describing a rise in both e-commerce and consumer spending as fueling the increase.

The volume has the overloaded ports hustling to keep up, but the ports’ struggle is industrial real estate’s gain. The shipments coming in are a significant driver of industrial demand in the greater Los Angeles area, with pronounced effects in the South Bay. With e-commerce’s rise remaining steady and retailers — already looking to build a buffer after the lessons of 2020’s supply chain snafus — getting an early start preparing for the peak shopping season later this year, CRE brokers and researchers don’t see a slowdown anytime soon.

In the submarket closest to the port complex, the South Bay, leasing activity totaled over 6.6M SF as of Q2 — 80% higher than the year prior, according to CBRE. A Cushman & Wakefield Q2 report noted that the South Bay has accounted for 29.2% of greater Los Angeles’ leasing activity this year.

As of Q2 2021, industrial vacancy in the South Bay remained less than 1%, CBRE said, while average industrial asking lease rates, at $1.14 per SF, were higher than any other area in greater LA. Cushman & Wakefield found the vacancy a bit higher at 1.8% and the average asking rents a bit lower at $1.08 per SF but noted that average was 12.5% higher than a year ago — a year when rents had already grown 7.2%.

“Occupiers that are hesitant to act due to the area’s high rents may have to overcome sticker shock if it means keeping warehouse and store shelves well stocked with the fall and winter holiday seasons rapidly approaching,” the authors of CBRE’s report wrote.

Though the high demand for industrial space is definitely being felt in the submarket closest to the port, the issue isn’t exclusive to the South Bay, experts said. Industrial space across the board continues to be in high demand across the greater LA area for the same reasons. The market saw an overall vacancy rate of 1.7% and net absorption of 3.5M SF in Q2 2021. Average asking rents increased by 12% year-over-year in Q2, averaging $1.03 per SF.

What are the driving factors behind the record increases?

Businesses are trying to receive products early and carry more inventory, Savills Executive Vice President and Head of Industrial Gregg Healy said.

“What’s driving all this consumer demand is the fear that if you don’t get your product in now, there’s geopolitical issues, there’s coronavirus-related issues, issues related to weather in Asia that may further delay shipments,” he said. “And all these issues are piling up.”

“To give you a real-life example of the kinds of challenges we’re seeing, one of our dedicated charters was recently denied entry into China because a crew member tested positive for COVID, forcing the vessel to return to Indonesia and change the entire crew before continuing,” Michael Witynski, Dollar Tree’s CEO, said on a Thursday earnings call. “Overall, the voyage was delayed by two months.”

As of August 30, 2021, forty-four freight ships are stuck awaiting entry into the Ports of Los Angeles and Long Beach, the highest number recorded since the beginning of the COVID-19 pandemic. “The normal number of container ships at anchor is between zero and one,” says Kip Louttit, the executive director of the Marine Exchange of Southern California. “Part of the problem is the ships are double or triple the size of the ships we were seeing 10 or 15 years ago,” Louttit said. “They take longer to unload. You need more trucks, more trains, more warehouses to put the cargo.”

The queue is a result of the labor shortage, COVID-19-related disruptions, and holiday-buying surges. Port of Los Angeles data indicated that the ships’ average wait time had increased to 7.6 days.

Source: https://www.bisnow.com/los-angeles/news/industrial/los-angeles-ports-industrial-real-estate-supply-chain-disruption-e-commerce-109799, https://f.datasrvr.com/fr1/121/52626/GLA_Americas_MarketBeat_Industrial_Q22021.pdf, https://www.businessinsider.com/shipping-delays-china-supply-chain-record-ships-stuck-california-ports-2021-8